November 24, 2013

After we frack them useless. Not content with trashing the environment, Cabot Energy is going into the home wrecking business. http://tomwilber.blogspot.com/2013/11/cabot-buys-second-polluted-residential.html?m=1 Friday, November 22, 2013 Cabot buys second polluted residential property in Dimock 12-acre parcel on Carter Road flanked by faulty gas wells The former Mike Ely propety, now owned by Cabot Cabot Oil & Gas has closed a deal for a second residential property affected by chronic methane pollution in the heart of its prolific gas operations in Susquehanna County, Pennsylvania. The Texas-based company paid Michael Ely $140,000 for the 12-acre property that includes a doublewide modular home, according to records filed in Susquehanna County Courthouse Wednesday. The property – now vacant — borders the intersection of the south end of Carter Road with State Route 3023 in Dimock Township. The […]

Read the full article →

November 13, 2013

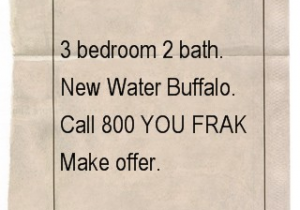

One mortgage at at time - from The Stephanie at EcoWatch: Fracking People’s Houses: Drilling Decreases Property Value Resource Media |November 13, 2013 1:39 pm | Comments 489 2Share0 2 521 Drilling conflicts are almost always described in the context of their impacts on air, water andhealth. But increasingly, as the drilling boom sweeps the country, another part of the drilling story is starting to bubble up in drilling hotspots like Colorado, Pennsylvania, New York, Wyoming and Texas.Increasingly, oil and gas development is butting up against, and often trampling, the bedrock American principles of property rights and the value of one’s home.Industry estimates peg the number new wells that will be drilled across the U.S. over the next decade at more than 200,000. In this rush to tap once unreachable deposits, oil and gas development is pushing the […]

Read the full article →