Below is the link to the longer research piece titled: Pretending to Forget What’s Right Under Our Feet Until the Ground Gives Way: EXCO’s Marcellus Gambit, the SAGO Mine Disaster, and the Price of Natural Gas.

I have included brief excerpts from the opening of each section.

From the opening section:

Why Philosophy Matters to Fracking: The Past is the Future

Long ago the foresightful German philosopher Friedrich Nietzsche argued that human beings were the sorts of creatures who, in the quest to advance their own self-aggrandizing interests, were compelled to forget acts of violence willingly committed to those ends. And not only acts of violence, but also deceptions, corruptions, swindles, exaggerations, extortions—in short all manner of iniquity for the sake of “progress” or “freedom” or “beauty” or “truth.” The trick, argued Nietzsche, is to insulate ourselves not merely from the notion that ends do not always justify means, but from having to remember the means at all.

Glory, after all, sounds a bit tinny heralded while walking over the bodies of the dead. Better that we should forget to look under our feet. Better that we should think of reason as an instrument of execution rather than a directive to conscience.

Such, Karl Marx argued, is the genius of capitalism: if each of us as workers and consumers can be convinced that what matters is the product—and not the process required to achieve it—we can be persuaded to participate in all manner of atrocity. What we have to believe is that the product is something we can’t live without, or that it makes us better, or that wanting it is our moral or religious or patriotic duty.

That such an extortion of consent requires the appropriation of reason to the task of “how” over “why” is certainly an enormous task—one that arguably epitomizes modern fascism as the corporatist domination of the state. Put in simpler terms, what effective marketing depends on is a kind of perverse social contract, one in which we collectively agree to forgetjust what sort of wounds we are willing to call mere “process” for the sake of a product upon which our dependence—however real—is made not of need but of created need.

And that is not the same thing at all—but, I’ll argue, it’s vital to the extraction industries that we should forget the difference.

Enter EXCO Resources, Inc, a natural gas corporation who, like all of its compatriots engaged in the Marcellus Shale Play, locates its raison d’être in the assumption that our need for fossil fuels is so great that we will sanction—forget—whatever EXCO does to get to the gas.

Like the addict who vanquishes all memory of the crimes they committed to get the heroin into their veins, so too EXCO counts on each of us—leased and un-leased, Shalers or non, gas field workers or ordinary consumers—to forego remembering the dirty lineage of that gas. The past, after all, portends the future; better to forget the past. The trouble is that when that future is climate change or war over access to the very water perversely fueled—literally—by the gas extraction process that destroyed it, the past will as surely return to haunt us as the name of the future is ecocide…

The sections which follow are titled:

Forgetting, #1: EXCO at Fake Community Meeting, DCNR State Forest Headquarters, January 2013:

The central cast of this first story of forgetting includes EXCO CEO Douglas Miller and Billionaire investor Wilbur Ross. It begins at a Sullivan County Energy Taskforce Meeting, DCNR (Department of Conservation and Natural Resources), January 8th, 2013 at the DCNR State Forest Headquarters in Laporte, Pennsylvania. Despite the fact that it was advertised as a “community meeting” aimed at providing information to its audience about EXCO’s drilling plans for Sullivan County, it became evident that the horizontal slickwater hydraulic fracturing corporation’s real motive was to sell audience members on the wonders of fracking sufficient to get them—mostly older folks—to sign leases before they left the building.

Indeed, we were informed at the door sign-in that landmen and EXCO lawyers would be available to negotiate leases (http://www.nofrackingway.us/2013/01/09/fake-community-meeting-exco-lookin-for-some-love-money/). Nowhere, however, was what is arguably a misuse of a public building for purposes of marketing spelled out in the public announcement of the “community meeting…

Forgetting, #2: EXCO CEO, Douglas Miller, Tries to Leverage a Buy-Out Bid While Billionaire Investor, “Distressed Company Restructurer,” and SAGO Mine Owner, Wilbur Ross, Jr. Stands By Like the Wolf at the Door:

Fact is, Douglas Miller needs his wells to produce. In January, 2011, the New York Times reported that

The board of Exco Resources, an oil and gas producer based in Dallas, said on Thursday that it was considering a buyout offer made by Douglas H. Miller, the company’s chief executive officer, which values Exco at $4.35 billion.

Mr. Miller told the board in October that he was interested in buying the company. He offered $20.50 cash for every share he did not already own, 38 percent above the share price before his bid was announced. The offer is yet another sign of the active management-led-buyout market.

The board said that it had “determined it is in the best interests of shareholders to commence a comprehensive and independent review of strategic alternatives to maximize shareholder value.”

(Exco Board Weighs Douglas Miller’s Buyout Offer – NYTimes.com)

It’s notable that Miller’s 38% premium ($20.58 per share) offer to take publicly traded (2006) EXCO private was even spicier than Exxon’s 2009 acquisition of XTO at a mere 25% (Betting on Exco Resources and Natural Gas – NYTimes.com). Indeed, despite the sharply falling price of natural gas, and even despite Exxon’s shareholder displeasure with the acquisition of XTO, Miller was apparently feeling pretty confident about his bid.

And why not? “Exco shares rose 26 cents, or 1.36 percent, to $19.34 on the news,” (Exco Board Weighs Douglas Miller’s Buyout Offer – NYTimes.com), sufficient to gain the support of support of T. Boone Pickens who reportedly owns 9.2 million shares in the company. Plus, Miller was receiving good news from the frack fields:

The company also announced significant increases in its proved and unproved natural gas reserves, saying that they had grown 28 percent and 114 percent, respectively, from the previous year. Exco claimed 1.5 trillion cubic feet of proved natural gas reserves as of December 31, and said increases were coming from drilling in its Haynesville shale assets. (Exco Board Weighs Douglas Miller’s Buyout Offer – NYTimes.com).

The Haynesville “shale play,” however, is in Louisiana—not Sullivan County (or anywhere county), Pennsylvania (EXCO Resources).

Turns out that Miller’s confidence—and hence the money he needs to make good on this bid—may have been a wee bit premature. Almost exactly one year after the New York Times reports that “Mr. Miller is hardly going out on a limb with his offer” (Betting on Exco Resources and Natural Gas – NYTimes.com), the Wall Street Journal informs its readers, November 2011, that he’s “licking his wounds from a botched effort to take his natural-gas company private” (Failure Has Its Rewards: Exco CEO Gets $3.3 Million – Deal Journal – WSJ). What happened?

Eight months go by, and no deal. Exco shareholders and employees start to get a little antsy and curious when and whether Miller was going to pull the trigger on a buyout. No other suitors seem interested in offering a rival takeover proposal. Then this summer, Miller made the unusual conclusion that his own company wasn’t worth nearly as much as he thought.

Or, rather, Miller realized he couldn’t borrow enough money to buy Exco on the terms he initially proposed. Instead, Miller tried to cobble together a deal to buy just a chunk of Exco, a deal that would have been cheaper but still leave Miller in charge. In July, Exco threw in the towel altogether on the idea of selling the company.

And where did that leave Exco shareholders? With a company whose market value has shriveled as much as $2 billion since Miller’s offer last fall.

(Failure Has Its Rewards: Exco CEO Gets $3.3 Million – Deal Journal – WSJ)

Key Phrase: “Miller realized he couldn’t borrow enough money to buy Exco,” not even a “chunk.” Incredibly, Miller is—true to the new American Way—rewarded for this spectacular failure:

And for his good work this year, Miller is being handed cash and stock awards with a current value of $3.26 million.

According to a regulatory filing today, the Exco board approved a $500,000 cash bonus to Miller based on the compensation committee’s “assessment of 2011 performance.” Miller also was awarded 266,317 shares of restricted stock. At Exco’s closing stock price Wednesday, those shares are valued at $2.76 million.

(Failure Has Its Rewards: Exco CEO Gets $3.3 Million – Deal Journal – WSJ)

Speaking of “chunks,” that’s quite a chunk-o-change—a fact which doubtless creates considerably more pressure on Miller to get those Sullivan County wells to come in.

Enter Billionaire Investor Wilbur Ross, Jr…

Forgetting #3: EXCO in Sullivan County, Pennsylvania, the Price of “Exceptional”

Were I Douglas Miller, I might be dreaming in the King’s English, but I’d be having nightmares in Chinese. Or—nearly, but not quite. As was reported in February 2013, if Miller could get those Marcellus wells producing, connected to pipeline, the gas ready for transport, he might yet be able to pull out some sort of deal.

Enter the one investor who controls more EXCO stock than Wilbur Ross, Howard Marks of the investment firm underwriting Miller’s buyout bid: Oaktree Capital Investments (Oaktree home page). “In addition to Wilbur Ross, Howard Marks has also built a position in XCO of 37 million shares, representing 5% of his portfolio according to Insider Monkey… In fact, put together Ross’ 32 million shares and Marks’ 37 million shares and that accounts for more than half of the float of 132 million shares.

In July 2011, XCO’s CEO put together a deal to take the company private at $18.50/share. Although the deal fell apart, Oaktree was one of the funds enlisted to facilitate the buyout.” (EXCO Resources – Wilbur Ross, Howard Marks All In On This Beaten-Up Stock – Seeking Alpha). Could Marks keep the Ross-Wolf outside the EXCO door? Perhaps. This seems clearly in the interests of Oaktree—but what it all depends on is not just the success of the shale play, but a rise in the price of natural gas, and this, of course, depends upon creating both domestic and global markets for it. Hence it’s no surprise that EXCO secured a recent 50% interest in TGGT, a midstream “gathering system” pipeline in North Louisiana and East Texas (EXCO Resources), partnered with Harbinger Group, Inc. to the tune of 597.5 million paid to EXCO, and whose aim is to create “a private oil and gas joint venture that will buy and operate Exco properties in Texas and Louisiana” (Harbinger, Exco form oil and gas joint venture – Yahoo! Finance).

It’s also no surprise that Wilbur Ross is romancing the Chinese.

With so much pressure to make his Marcellus Shale Play come to fruition, it’s no wonder that MIller might be willing to cut whatever corners he can to get production moving. Hell’s bells, he already has. Welcome to EXCO’s newest “play” on PA State Game Lands: The EXCO Elk Grove Hunting Club, Pad 1-9H…

Forgetting #4: Mountains of Charlatans:

The scale of charlatans deployed throughout the Marcellus shale play is impressive and plentiful. It includes those, like Douglas Miller and Wilbur Ross, whose power and influence can buy them cover behind the promise of things like jobs, sponsored community events, new school buildings, improved roads, donations to charitable organizations—all investments in our complicity, our indebtedness, and our silence. Organizations like the Marcellus Shale Coalition and the notorious anti-regulation hit squad Energy in Depth run interference for an industry seemingly intent on ripping the last fossil fuel dollar from under our feet even at the risk of converting the state into a future super fund site.

The ace of the Marcellus shale play, of course, lay in the promise of jobs. If we can be persuaded to simply forget the role Big Energy played in the 2007 banking crisis, the ensuing Great Recession, and the stock market plummet, we can be convinced that corporations like EXCO have our best interests at heart, and that the evidence is in the well-paying proliferation of employment in the enormous array of directly related—say, well-pad construction—or ancillary industries—say, motels and taverns—benefitting from fracking—at least during its boom.

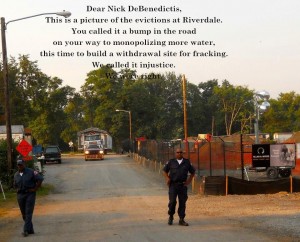

The young Karl Marx argued that when the value of a human being becomes commodified as the exchange value of her or his labor—once that exchange value is internalized—workers can be counted on to identify their own interests with that of their bosses, well, their bosses’ profits. Such was brought home to me recently in a particularly crude attack on a photograph I had posted in an album some months ago on Facebook.

The photograph depicts a mobile home being removed after the end of the resistance at Riverdale Mobile Home Community when the land was sold to Aqua America for the construction of a water withdrawal site for frack operations near Williamsport. I had tagged the picture with a critical appraisal of Aqua America’s motives, and for reasons unknown to me a passel of fracking industry workers alighted on it, and began what became 204 comments worth of declamatory assault which included calling me a “scum-sucking bitch” and offering me salacious opportunities to join them in their frack water hot tubs, among other things…

{ 1 comment… read it below or add one }

Outstanding Wendy - Thank You!

“I would not give a fig for the simplicity on this side of complexity, but I would give my life for the simplicity on the other side of complexity.” Oliver Wendell Holmes

Such a hard wall on this side - harder than ever these days. What now pass for “reason” and “rational thinking” just bounce off and float around our Great Mad Carnival.

Grateful for your efforts…