There are 3 rules of business:

1. Logic does not apply

2. When the right person gets pissed, something will be done.

3. If you don’t own the company, you’re expendable.

Aubrey McClendon forgot rule 3.

When Chesapeake Energy went public in 1993, McClendon no longer “owned” the company; he became an employee and served at the pleasure of the Board of Directors and shareholders. At that time, as Chairman of a hand picked board of directors his job as Chairman and CEO was secure.

On Tuesday (1/29/13), Chesapeake announced the billionaire co-founder, chief executive, and president has “agreed to retire” by April 1. McClendon noted his “philosophical differences with the new Board.”

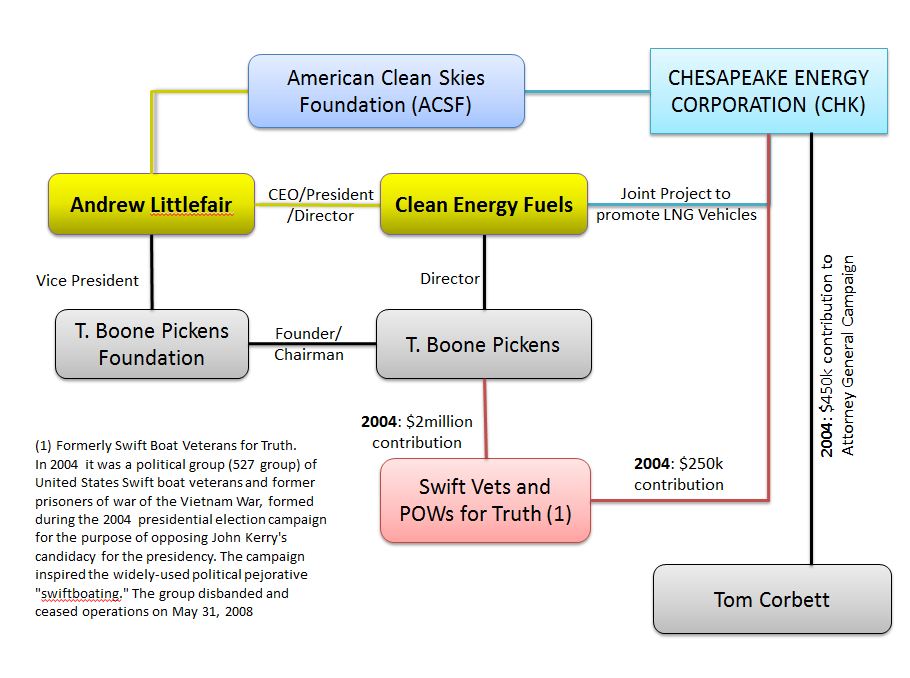

Last year, amidst news of private loans, private hedge funds, investigations by the Securities Exchange Commission (SEC), and suspicions of colluding with EnCana Corporation to suppress land lease prices, Aubrey lost his BIG seat as Chairman of the Board of Directors.

In the spring of 2012, billionaire Carl Icahn became the 2nd largest shareholder of Chesapeake Energy, owning 13.5% of the shares. Southeastern Asset Management, led by Mason Hawkins, owns 13.6%. Together, they took control of the nine member board. A number of board members were replaced.

Archie W. Dunham, former Conoco CEO/President, became the new chairman. Dunham was Chairman of Conoco-Phillips, following the merger of Conoco Inc. and Phillips Petroleum Company, until his retirement on September 30, 2004.

The “new improved” Chesapeake began selling off assets to raise capital. Among the first to be sold was its midstream operations – Chesapeake Midstream (CMP). It was sold to Global Infrastructure Partners (GIP) in July 2012 for $2-billion dollars, some midcontinent gathering and processing assets of CMP and all of its interests in a subsidiary, Chesapeake Midstream Development, for another $2 billion.

Other asset sales include:

- April 9, 2012: Obtained $1.25 billion from preferred shares in the Cleveland Tonkawa to a Blackstone led investor group

- April 9, 2012: Raised $744 million from a Volumetric production payment to Morgan Stanley

- April 9, 2012: Got $572 million for land in the Texoma Woodford play to Exxon

- September 12, 2012: Announced raising $600 million selling non-core Utica shale assets

The deals keep the company afloat for 2012. Still, they do not significantly close the gap between the amount Chesapeake needs to spend in the future to maintain its current growth and its projected revenue.

Chesapeake will need to fill a funding gap of at least $4 billion in 2013, Barclay’s analysts estimate.

For the past couple of years, Chesapeake has been falling behind in paying bills, and royalties to property owners.

There are also unverified rumors of problems meeting payroll for workers at drill sites in Pennsylvania. Adding to the rumor mill, in some areas of Pennsylvania, Chesapeake has taken to holding informational meetings with angry property owners in an effort to mollify them. Property owners either did not receive a check, did not receive a check in the amount expected, or received a “BILL” for post production instead of a check.

With regards to not paying bills on time, this may result in property owners having a Mechanics Lien place on their property. Such a lien holds the PROPERTY OWNER responsible, not Chesapeake, and may pose problems in the future for refinancing and/or selling the property. Property owners are usually not even aware that such a lien may exist until they try to refinance or sell.

To further muck things up, there is the issue of McClendon’s 2% stake in every well drilled via the Founders Well Participation Program (FWPP). The FWPP allows McClendon to personally own 2.5% of every well, it also means he is responsible for 2.5% of the production costs. Hence, the formation of a number of personal corporations

McClendon set up a few personal corporations. These include:

- Arcadia Resources, LLC

- Jamestown Resources, LLC

- Larchmont Resources, LLC

- Pelican Energy, LLC

Property owners, who have taken time to check out their paperwork at a Registry of Deeds, may have been surprised to see these names listed, and wondered who the heck are they and why are they on there. Many have been told “Oh, it’s just part of Chesapeake Energy, don’t worry about it”.

McClendon borrowed heavily against his 2.5% stake, and has borrowed as much as $1.1 billion in the last three years by pledging his stake in the company’s oil and natural gas wells as collateral the documents reviewed by Reuters show.

For other loans, McClendon has used his life insurance policy and wine collection as collateral.

“In a Goldman Sachs filing, Mr. McClendon offered as collateral his wine collection, detailed on 78 pages listing the vintages held in his homes in Minnesota, Michigan, Bermuda and Oklahoma City.”

Now that’s scraping the bottom of the barrel.

Don’t count McClendon down and out. It won’t be long before he turns up on some other board of directors or similar. This is how the game of musical chairs is played in the corporate world.

The Board of Directors has also delayed the release of their internal investigation into McClendon’s loans and related activities. Originally, the report was scheduled to be release at the end of December 2012, it was then pushed to the end of January 2013. Now they are saying by end of February 2013.

My guess is the report currently blames everything on McClendon, and this led to him being given the option to “retire”. The delay to end of February in conjunction with the McClendon’s “retirement” leads me to believe the report is going under a major rewrite to fuzzy-up the details.

What does it mean for Chesapeake’s natural gas drilling activities going forward? Nothing. Business as usual. There have been rumors of Chesapeake being bought out by larger corporations, but for the people living the drill, it still will be business as usual.

With an April Fools Day date of actually “retiring” from Chesapeake Energy, it brings up the question of parting gifts. Will the parting gifts be short about $12-million (plus 2.8% interest) to buy back the antique maps McClendon sold to Chesapeake? Will McClendon be rewarded for failure and given an outrageous severance package? If so, then the April Fools joke will be on the shareholders.

As far as property owners with mechanics liens, lower than expected royalties, or bills for production costs. The joke is on them too.

Related Chesapeake Energy Posts:

- Chesapeake Energy – Job not finished until paperwork is done - Part 1

- Chesapeake Energy – Behind the Curtain – Part 2

- Chesapeake Energy: A Problem like Aubrey – Part 3

- Chesapeake Energy: It’s Raining Shoes – Part 4

- Chesapeake Energy – Hiding in the Bushes

- Chesapeake Energy – When the Thrill is Gone in Utica

- Aubrey and Ralph – BFF Through Boom and Bust?

©2013 by Dory Hippauf

{ 3 comments… read them below or add one }

Great day for Earth, and humanity. Thanks, Dory!

Well, Liz, in the big picture, Aubrey’s “retirement” means nothing, its still business as usual for Chesapeake, which means people and environment remains at risk

Aubrey McClendon and Chesapeake Energy are prime examples of what is wrong in America today. Ethics, morals or obedience to laws is meaningless in the world of corporate America. The people are not protected from charlatans who lie, cheat, steal and intimidate to grab all they can from whomever they can, and do so with the blessings of government at all levels.

If there was any justice, then McClendon would be sharing a room with Bernie Madoff, but that is a really scary thought because the two of them would probably plan a way to con people out of money while they are incarcerated so that they have huge nest eggs when they are released, probably sooner than they should be due to some payouts to the right judges and politicians.

It is ironic that the very success generated by Chesapeake is the cause of the failure of natural gas for all companies in that industry today. At a current market price of about one third the production cost the gas industry is losing money faster than a drunken sailor in San Diego. Unfortunately, a lot of good people who thought they had a ticket to board the gravy train are going to find themselves in the soup line instead.