The New York Times article “After the Boom in Natural Gas” | By CLIFFORD KRAUSS and ERIC LIPTON | October 20, 2012 caught my attention, specifically, one sentence: “Like the recent credit bubble, the boom and bust in gas were driven in large part by tens of billions of dollars in creative financing engineered by investment banks like Goldman Sachs, Barclays and Jefferies & Company.”

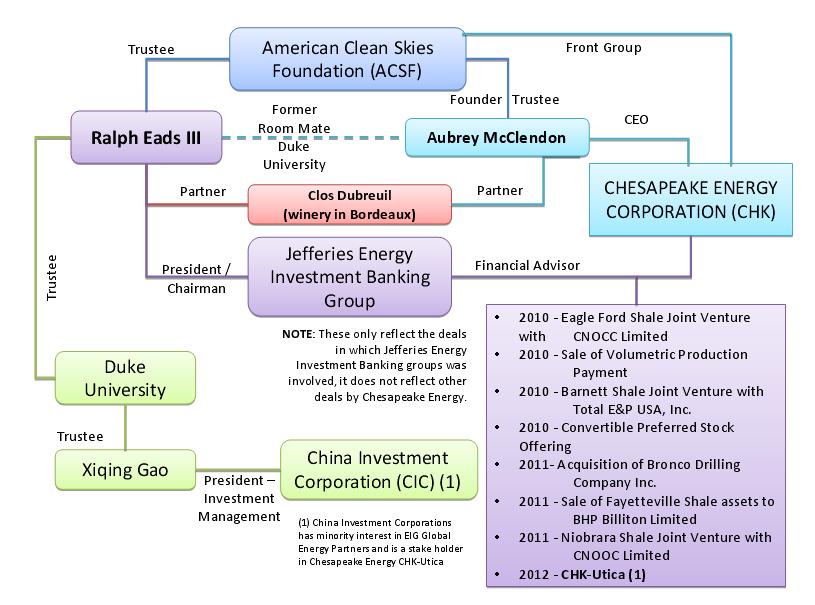

Aubrey McClendon, CEO of Chesapeake Energy and Ralph Eads III, the Chairman of Jefferies Energy Investment Banking Group (division of Jefferies & Company) go way back in their association.

McClendon and Eads were Sigma Alpha Epsilon fraternity brothers at Duke University.

Prior to joining Jefferies, Eads was Co-President of Jefferies Randall & Dewey. In February 2005, Jefferies acquired Randall & Dewey, which became Jefferies’ Energy Investment Banking Group. Eads was President of Randall & Dewey.

His career includes being the Executive Vice President of El Paso Corporation, where he was responsible for El Paso’s unregulated businesses.

Complex El Paso Partnerships Puzzle Analysts

By DAVID BARBOZA | Published: July 23, 2002

Excerpt: El Paso created a Merchant Energy division and hired Ralph Eads, the company’s well-respected investment banker at Donaldson, Lufkin & Jenrette, which was acquired by Credit Suisse in 2000. In a fast-deregulating energy market, Merchant Energy would encompass gas and power trading and follow a new strategy of acquiring old power plants and renegotiating their longterm contracts with utilities.

Previously, he was Managing Director and head of the Energy Group at Donaldson, Lufkin & Jenrette. He has held investment banking positions at S.G. Warburg, Lehman Brothers, and Merrill Lynch.

Eads is on the Board of Trustees for Duke University. Also on the Duke Trustee board is Xiqing Gao, the Vice Chairman, President and Chief Investment Officer of the China Investment Corporation (CIC), China’s sovereign investment fund. CIC has minority interest in Chesapeake Energy’s CHK-Utica in Ohio.

McClendon and Eads are partners in Clos Dubreuil, a winery in Bordeaux, France.

Jefferies Energy Investment Banking Group, acting as financial advisor, has assisted Chesapeake Energy with many of its recent ventures which include CNOOC Ltd of China, Hopu Investment Management Co. Ltd. of China, Statoil of Norway, and Total SA of France. While Chesapeake Energy is not the sole client of Jefferies, Chesapeake is a substantial client in comparison.

In the past few months, Chesapeake Energy took a beating and has only recently crawled back up. The “Aubrey problem” has contributed to the lack of enthusiasm from various market analysts.

While many market analysts had downgraded Chesapeake from “Buy” to “Hold”, or “Hold” to “Sell”, the analysts at Jefferies defended their “BUY” rating.

Jefferies said that the sale of some of the company’s assets in the Marcellus Shale should help bridge the 2012 funding gap. Commenting, the analyst noted that “Progress along this front should result in the stock reflecting more of the upside embedded in CHK’s asset base. An update on the Utica JV should be imminent.”

Regarding the $4-billion dollar loan to Chesapeake, a May 18, 2012 Bloomberg article described it as: (emphasis added)

McClendon is depending now on his Jefferies confidant at an even more crucial moment. Falling gas prices, combined with the buying binge, is forcing Chesapeake to unload assets to keep the company afloat. Along with Goldman Sachs Group Inc. (GS), Jefferies bankers are seeking buyers for oil-rich prospects and lending Chesapeake $4 billion in the meantime.

“Without Wall Street, Chesapeake wouldn’t be able to do what it has done,” said Phil Weiss, an analyst at Argus Research in New York who rates the shares “sell.”

Eads and New York-based Jefferies declined to comment.

“Ralph Eads and Jefferies have unmatched expertise in the E&P business and have added enormous value to Chesapeake’s business and its shareholders over many years,” Chesapeake said in a statement, referring to the exploration and production industry. “We deeply value our long-term relationship.”

Back to the NY Times Article:

Excerpt (emphasis added):

Aubrey K. McClendon, chief executive of Chesapeake Energy, had a secret, and he was anxious to share it.

He called Ralph Eads III, a fraternity buddy from Duke who had become his go-to banker. Mr. McClendon explained that he had quietly acquired leases on hundreds of thousands of acres somewhere in the southern United States — he would not say exactly where — that could become one of the world’s biggest natural gas fields.

But to develop the wells, he needed billions of dollars.

“I can get the assets,” Mr. McClendon told Mr. Eads, a vice chairman of Jefferies, according to three people who participated in that call, nearly five years ago. “You have to get the money.”

Excerpt (emphasis added):

In private, Mr. Eads acknowledged that his pitches involved a bit of bluster.

“Typically, we represent sellers, so I want to persuade buyers that gas prices are going to be as high as possible,” Mr. Eads said. “The buyers are big boys — they are giant companies with thousands of gas economists who know way more than I know. Caveat emptor.”

In 2010, Chesapeake Energy tried to sell their gas lease interests in Michigan to Encana. Reuters uncovered interesting emails: How Chesapeake tried to unload “worthless” acreage | By Brian Grow and Joshua Schneyer | Tue Oct 2, 2012

Excerpt (emphasis added):

Chesapeake executives knew that their test well in Michigan had performed poorly. But the emails indicate that McClendon wanted to provide Encana just enough information about Chesapeake’s well to keep the sale talks going, without showing the well’s full - and disappointing - results.

“But isn’t our possible gain that they could want to buy our (now worthless) leases?” McClendon wrote to three top Chesapeake officials on October 31, 2010. The words in parentheses - “now worthless” - were his. So was the suggestion to provide Encana barebones information.

“We need to know what is the data that we could release to Encana that makes us look like we have nothing to hide, yet won’t show anything negative about the play?” he wrote in the same email.

Encana did not buy the “worthless” leases. Chesapeake is now trying to sell them to someone else.

Chesapeake Energy is Selling Oil, Gas Acres In Michigan (2012) | By Ben Lefebvre

Excerpt: Chesapeake Energy Corp. (CHK) is selling 450,000 net acres in oil-and-gas fields in north-central Michigan, the third parcel of land the cash-strapped company has put up for sale in just over a week, an advisory firm said Thursday. The Oklahoma City natural-gas company is trying to raise money to rein in an estimated $10 billion cash shortfall brought on as natural-gas prices have tumbled.

Excerpt: The assets the company has since put up for sale could be valued at another $15 billion, although buyers for natural-gas assets could be difficult to find, analysts have said. Last month, Chesapeake secured $4 billion in loans from Goldman Sachs Group Inc. (GS) and Jefferies Group Inc.’s (JEF) Jefferies & Co.

Surprised? You shouldn’t be - that’s what friends are for……

Surprised? You shouldn’t be - that’s what friends are for……

For more on Chesapeake Energy see:

- Chesapeake Energy – Job not finished until paperwork is done.

- Chesapeake Energy – Behind the Curtain – Part 2

- Chesapeake Energy: A Problem like Aubrey – Part 3

- Chesapeake Energy: It’s Raining Shoes – Part 4

Remember the energy crisis in California back in 2001? Remember Enron? More on Ralph Eads III and El Paso:

El Paso Corp. Executive Tells Regulators of Collusion on Natural Gas Deal

THE NATION | THE ENERGY CRISIS

May 25, 2001|RICARDO ALONSO-ZALDIVAR | TIMES STAFF WRITER

Excerpt: The admission by El Paso executive Ralph Eads marked a shift from his previous testimony and was elicited through sharp questioning by an angry judge who threatened to subpoena Eads’ boss.

At issue is a February 2000 contract between El Paso Merchant Energy Group, a subsidiary that sells natural gas, and El Paso Natural Gas Co., another subsidiary that owns and operates pipelines. El Paso Merchant paid $38.5 million last year for the right to ship as much as 1.2 billion cubic feet of natural gas per day to California.

The California Public Utilities Commission alleges that El Paso Merchant took advantage of the deal to withhold shipping capacity on the pipeline, creating an artificial shortage that sent Southern California prices soaring.

Southern California Edison estimates that El Paso Merchant’s actions added $3.7 billion to the state’s total energy bill, since most power generators rely on natural gas.

The El Paso companies deny any impropriety and blame increased demand, low storage capacity and other independent factors for a fivefold increase in California natural gas prices since early last year. El Paso’s lawyers have called the $3.7-billion estimate “absurd.”

Eads, president of El Paso Merchant, testified Thursday that he obtained the tacit approval of William A. Wise, head of corporate parent El Paso Corp., for the contract with El Paso Natural Gas Co.

Only 24 hours earlier in the same courtroom, Eads had portrayed Wise’s role in the pipeline deal as marginal. Eads had suggested that he merely briefed Wise on a deal that Eads was in charge of.

But on Thursday, Judge Curtis L. Wagner Jr., apparently relying on company documents that remain under court seal, said Eads’ explanation was not believable.

“I think I’m being given the run-around on this,” Wagner told Eads in open court, startling lawyers for both sides into a dead silence. “I am just appalled that you are trying to pull something over my eyes.”

————-

© by Dory Hippauf

{ 9 comments… read them below or add one }

Hmmmm……………… Wonder if Aubrey and Ralph are good enough friends to share a cell at a federal prison?

Thanks Dorothy for your research and information sharing. The industry and their pet politicians days are truly numbered as folks are extremely motivated to expose that the only real game changer in fracking has been to cheat the American public out of their property values, health, and future livibility of this planet. As as new spud spuds an activist, we are not helpless, we are machines destined to grow our movement to kill extreme fossil fuel pursuits and show that green jobs are sustainable AND more productive.

Very nice work . ..

Surely EID will do a hit piece on you now. Keep a flashlight handy in case you hear rustling around your trash cans late at night.

What was I thinking? They don’t need to dig through your trash for evidence. Fracking’s Joe Camel scoffs at evidence. They just make sh*t up.

Before they go rooting around in the trash cans, they might have to discuss those plans with the local bear and my 160lb Great Dane might want to add a few comments too

Coincidentally(?)…

2 recent reports… re-inflating the bubble ? :

http://www.duluthnewstribune.com/event/apArticle/id/DA21G2P02/

One report is from ITG (International Trading Group):

“…a detailed analysis of Marcellus well production data suggested that federal government estimates of its reserves ‘are grossly understated.'”

From the Times article:

“Analysts rate drillers on their so-called proven reserves, an estimate of how much oil and gas they have in the ground.”

ITG was founded in 1984 by Jefferies and became “independent” in 1999.

Oh, Yeah…

Well done.

Read your post after the NYTimes article…. clearly, there is growing interest in these things and we will see more and better reporting on it in the MSM. I hope that they follow your breadcrumb trail here. Fortune has been pretty on-top of this stuff….

vote for move to Delaware, Audrey can again rename his team the Delaware Drillers and build a new empire of cards.