Fracking may already be DOA in New York before it’s begun. Somebody might tell Cuomo before he issues regulations in haste for drilling that is an economic bust north of the state line.

The ponzi fracking financing that fueled the shale rush is over for dry gas, and the shale gas prospectors that signed gullible farmers to cheap leases, like Norse Energy, the 2nd largest holder of shale gas permit applications in New York, are now trying to unload their New York properties - cheap and fast, possibly because they are mainly out of Cuomo’s Sacrificial Frack Zone and they will likely expire before dry shale gas becomes economic - ie. goes over $5 mcf. By which time many of the speculators’ gas leases will have expired. This was not only predictable, it was predicted by any financial analyst, geologist or journalist that was not part of the fracking ponzi scheme.

Art Berman is a retired geologist that has written about how horizontal drilling plays have been historically over-hyped, from the first ones in the Austin Chalk and San Juan Coal Seams, to “400 Tcf” Terry Engelding’s wild overstatements about the Marcellus. Predictably, the shale is not uniformly productive, and what wells are productive tend to play out quickly. Even a Texas goatherd can figure that out.

According to Arthur Berman, an experienced oil and gas industry geologist based in Houston, Texas, a review of the numbers coming out of those shale gas regions show troubling trends. Berman recently released a presentation titled, “After the Gold Rush, A Perspective on Future U.S. Natural Gas Supply and Price”. In his presentation Berman cites, among other things, the following:

• Shale gas production from the Haynesville formation currently has a 48% annual output decline rate and despite the addition of 724 new producing wells in the last 12 months, shale gas output has now peaked and appears to be declining.

• It will take more than $13 billion in drilling costs simply to replace the 48% annual output decline of the Haynesville region which translates to finding and replacing an estimated 3.5 billion cubic feet of shale gas per day. The Haynesville region, according to Berman, accounts for 11.5% of all U.S. shale gas production.

• In the Texas Barnett shale formation “Current production is still flat” according to Berman, even as he noted more than 1,250 new producing wells in the last 12 months. Berman notes that the Texas Barnett shale formation supplies roughly 9% of all U.S. shale gas production.

• Berman has calculated a 29% annual base rate decline in production within the Texas Barnett which now requires more than 5,734 wells at an estimated cost of $17 billion simply to keep production at its current level.

The overall message of his presentation continues to state the rapid depletion rates of shale gas wells combined with their much higher operating costs compared to conventional oil and gas wells means shale gas must have significantly higher market prices in order for the companies to even approach breakeven let alone a profit or that of a profit which will satisfy their investors.

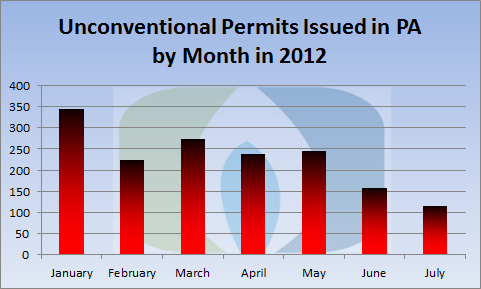

Such is the case in Pennsylvania, where drilling permits have fallen off a cliff, down 70% this year, including in the “wet gas” areas. There is No fracking rush in New York to shoot up the landscape prospecting for dry holes. Even in the fracking sacrifice zone.

http://www.fractracker.org/2012/08/unconventional-permits-declining-sharply-in-pa/

Drilling permits decline sharply Pa. Marcellus

New data released yesterday by the Pennsylvania Department of Environmental Protection shows a severe decline in new shale gas well permits issued for the first six months of this year. Permits issued by the State have declined sharply since January 2012 and dropped for the last three straight months for both new wells and “refracks” of existing wells. The significant declines in permits come at a time when the shale gas industry has been crossing over into Ohio for the more lucrative wet oil infused shale gas and leaving the Marcellus. Yet the Corbett Administration is in all-out effort to speed up the State’s permitting process and fighting hard to keep Act 13 prohibitions in place to prevent local townships from enforcing their own zoning ordinances when it comes to shale gas drilling.The State issued roughly 350 shale gas permits in January of this year while for July they issued a total of roughly 110 permits, more than a 70% decline. For May 250 permits were issued which decreased to 150 permits for June followed by another decline to 110 permits for July, a decline trend for permits which began back in 2011.

Further complicating the picture is the increasing role “refracking” is beginning to play in these operations. Refracking a well is used to keep up its output as aggressive production depletion rates remain a persistent fact of life for shale gas drillers. This means it is no longer clear from State’s data what permits are for new wells or to simply refrack existing wells needed to keep up output.

The declines for permitting are now occurring throughout the State including Susquehanna, Bradford, Tioga, Washington and Greene counties, the best “sweet spots” to date in the State for the industry. It appears not even the claims of wet oil infused shale gas in the southwest corner of the State are holding the drillers main attention.

Fractracker.org’s senior researcher Matt Kelso said the State’s data now confirms, “The industry is ramping down permitting, drilling and production efforts across the State for the time being.” Kelso also stated, “State data released yesterday now shows oil and gas production for the last 6 months to be just 50% of what was produced for the 6 month prior time period.” He cautioned the report may be incomplete as some shale gas companies have not reported thier production into the State DEP.

Kelso also observed the recent report by the Energy Information Agency regarding 2011 production rates which now have many claiming the Marcellus is well on its way to be the number one shale gas producer should be viewed realistically. He notes the EIA’s gas production report reflects results from the prior drilling ramp up activity in 2009 and 2010 and should be viewed in balance with recent drilling decline data from 2011 and year to date 2012.

Meanwhile Chesapeake Energy, BHP Billiton and numerous other gas companies heavily involved in shale gas drilling have written off billions of dollars in claimed shale gas reserves on their 2nd quarter financial operating results. This comes on the news the Texas Barnett and Louisiana Haynesville shale plays now appear to be peaking with annual production declines of 29% to 40% despite several thousand new wells coming online in these plays over the last year.

{ 2 comments… read them below or add one }

The Truth IS out there…

“What if shale gas is just a PR campaign (with horrific environmental side effects)?…what if the entire point of the exercise was to increase the capitalization of shale gas exploration and production companies?”

From “Shale Gas: The View from Russia” by Dimitri Orlov

http://cluborlov.blogspot.co.uk/2012/05/shale-gas-view-from-russia.html

“Alas, thanks to the Fed’s zero-interest-rate policy and the trillions it has handed over to its cronies since late 2008, the sweeps of creative destruction have broken down. Instead, boundless sums of money have been searching for a place to go, and they’re chasing yield when there is none, and so they’re taking risks, any kind of risks, in their vain battle to come out ahead. The result is a stunning misallocation of capital to the tune of tens of billions of dollars to an economic activity—drilling for dry natural gas—that has been highly unprofitable for years. It’s where money has gone to die. What’s left is debt, and wells that will never produce enough to make their investors whole.

But the money has dried up. And drilling for natural gas is collapsing.”

From “Natural Gas: Where Endless Money Went to Die” by Wolf Richter

http://www.testosteronepit.com/home/2012/6/20/natural-gas-where-endless-money-went-to-die.html

Richter has been writing about the natural gas “fiasco” all year. Here’s another…”Capital Destruction in Natural Gas”

http://www.testosteronepit.com/home/2012/6/4/capital-destruction-in-natural-gas.html

Chip…Thanks & please keep swing’n away

Note that, based on what Norse Energy is trying to unload - fast (by September 2012) and cheap - on terms, there is zero economic upside to drill for dry gas in New York - and hence zero demand. So the proposed “50 permits” a year may go begging - since the sacrificial counties are worse prospects than the Pa. counties on the other side of the border - where wells are only drilled to hold acreage. . . .

Ergo, no Fracking Rush in New York